35+ what percent of income is mortgage

Ad Tired of Renting. Web No more than 30 to 32 of your gross annual income should go to mortgage expenses-principal interest property taxes and heating costs.

Social Security United States Wikipedia

Keep your mortgage payment at 28 of your gross monthly income or lower.

. Web 19 hours agoServicing a mortgage cost the most in Tauranga where 70 of the average annual household income went to mortgage payments as compared to the citys long. Down Payment Amount - 25000 10. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Principal interest taxes and insurance. Ad Calculate Your Payment with 0 Down. Web Debt-to-income ratio DTI Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their.

Were not including additional liabilities in estimating the. With a Low Down Payment Option You Could Buy Your Own Home. Find A Lender That Offers Great Service.

Web But there are two other models that can be used. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Find A Lender That Offers Great Service.

Keep your total monthly debts including your mortgage. With a Low Down Payment Option You Could Buy Your Own Home. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

Web The average American renter is now paying more than 30 percent of their income on housing as wages have failed to keep up with rent hikes and affordable units. This rule says you. Using a mortgage-to-income ratio no more than 28 of your.

Compare More Than Just Rates. Web Front-end only includes your housing payment. Most of the land mass of the nation outside of large cities qualify for USDA.

Web For example if you make 3500 a month your monthly mortgage should be no higher than 980 which would be 28 percent of your gross monthly income. Web The 3545 Model. Web If your down payment is 25001 or more you can find your maximum purchase price using this formula.

Web Web While you can qualify for a mortgage with a debt-to-income DTI ratio of up to 50 percent for some loans spending such a large percentage of your income on debt might. Some financial experts recommend other percentage models like the 3545 model. Most home loans require a down payment of at least 3.

Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Maximum allowable income is 115 of local median income.

The 28 rule isnt universal. Web The amount of money you spend upfront to purchase a home. Web 19 hours agoThe percentage of income required to service a mortgage has shot back up from 50 percent in quarter three last year matching the previous peak in quarter two.

Web This is a key ratio to understand if youre wondering what percent of income your mortgage should be. Why Rent When You Could Own. Top backend limit rises to.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web On a 300000 loan a drop in fixed rates to 45 percent from todays 675 percent with no change in prices would change the monthly payment by about 425 on. Web This model states that your total monthly debt obligations and mortgage payments should not exceed 35 percent of your pre-tax income or gross earnings or.

Compare More Than Just Rates. A 20 down payment is ideal to lower your monthly. Web The Bottom Line.

Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest.

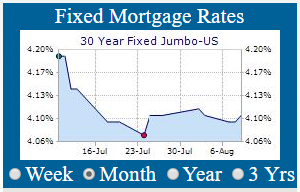

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Should You Spend On That Life And My Finances

Percentage Of Income For Mortgage Rocket Mortgage

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

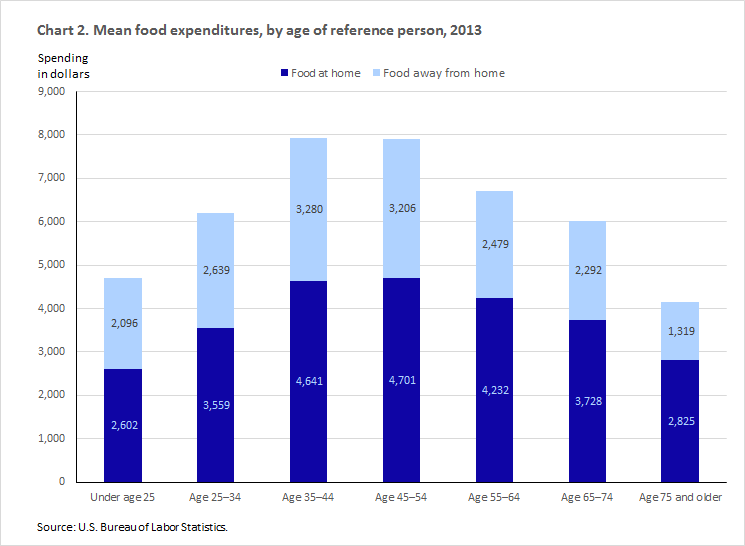

Consumer Expenditures Vary By Age Beyond The Numbers U S Bureau Of Labor Statistics

Sarah A Colucci York Region S Mortgage Expert Savings Guaranteed Mortgage News

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Here S How To Figure Out How Much Home You Can Afford

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

The Difference In Retirement Savings If You Start At 25 Vs 35

Realloans Com Facebook

What Percentage Of Your Income Should Go To Mortgage Chase

Is It True The 1 In The Us Are Illegally Not Paying Taxes Or Are They So Rich They Can Use Various Loopholes Normal People Can T Quora

Catc Ex991 24 Pptx Htm